What is an Enrolled Agent?

Enrolled Agents(EAs) are America’s Tax Experts. EAs are the only federally licensed tax practitioners who specialize in taxation and also have unlimited rights to represent taxpayers before the IRS.

What does the term “Enrolled Agent” mean?

“Enrolled” means to be licensed to practice by the federal government, and “Agent” means authorized to appear in the place of the taxpayer at the IRS. Only Enrolled Agents, attorneys, and CPAs have unlimited rights to represent taxpayers before the IRS. The Enrolled Agent profession dates back to 1884 when, after questionable claims had been presented for Civil War losses, Congress acted to regulate persons who represented citizens in their dealings with the U.S. Treasury Department.

Why an Enrolled Agent?

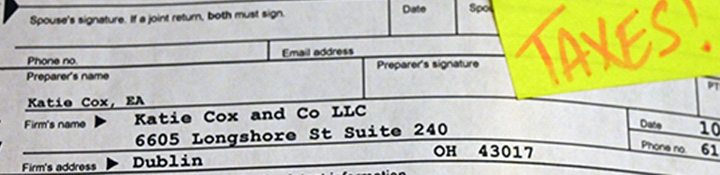

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test, or through experience as a former IRS employee. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years.

What are the differences between Enrolled Agents and other tax professionals?

Only Enrolled Agents are required to demonstrate to the IRS their competence in all areas of taxation, representation, and ethics before they are given unlimited representation rights before the IRS. Unlike attorneys and CPAs, who are state licensed and who may or may not choose to specialize in taxes, ALL Enrolled Agents specialize in taxation.